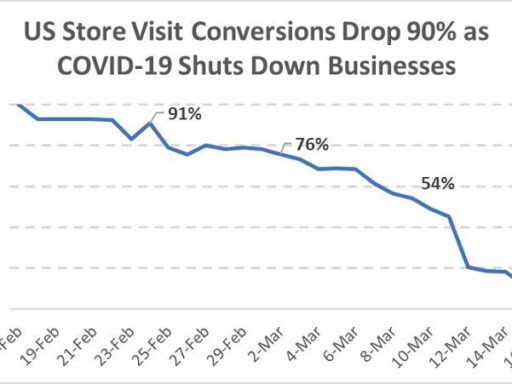

COVID-19 reshaped business with remote work, e-commerce growth, supply chain disruptions, digital transformation, and increased focus on health and safety. These shifts have fundamentally altered operational models and consumer behaviors. The pandemic has been a catalyst for remarkable change across the business landscape. Companies around the world had to quickly adapt, leading to the acceleration […]

How To Get Debtors To Pay Your Small Business

To get debtors to pay your small business, establish clear payment terms and communicate effectively. Utilize reminders, offer payment plans, and consider collection agencies as a last resort. Small businesses thrive on a stable cash flow, and when debtors delay payments, it can significantly disrupt operations. Ensuring that your clients or customers adhere to their […]

5 Cybersecurity Tips That Can Save A New Business

Secure your network with firewalls, and enforce strong password policies. Regularly update software to protect against the latest threats. Starting a new business comes with a multitude of challenges, but one of the most critical aspects that must not be overlooked is cybersecurity. Today’s digital landscape is rife with threats that can compromise sensitive data, […]

How To Grow Social Media For Your Business On A Limited Budget

To grow your social media on a tight budget, focus on content quality and audience engagement. Leverage free tools and strategies to maximize your reach. Growing your business’s social media presence without hefty financial backing can be a challenge, but it’s far from impossible. It requires a targeted approach, where your strategy pivots on creating […]

5 Awesome Benefits Of Excel For Businesses

Excel enables efficient data management and sophisticated analysis for businesses, fostering better decision-making and productivity. It streamlines processes with automation, saving time and resources. Excel, Microsoft’s powerhouse spreadsheet software, stands as an indispensable tool for businesses worldwide, swiftly processing large volumes of data and offering unparalleled versatility. With its powerful features for analysis, automation, and […]

7 Dos And Donts Of Succession Planning For Small Business

Do establish a clear succession plan early and involve key stakeholders; don’t neglect to review and update it regularly. Do train successors in all business aspects, but don’t choose them based solely on seniority or family ties. Succession planning in small businesses is vital to ensuring long-term sustainability and smooth transitions. It’s a strategic approach […]

How Poor Collaboration Can Erode Your Business

Poor collaboration can lead to project delays and reduced innovation. These setbacks often result in profit loss and decreased competitiveness. Effective teamwork is the lifeblood of any successful business. Lack of collaboration stunts growth and can undermine employee morale, leading to an unproductive work environment. Without cohesive teamwork, tasks are duplicated, time is wasted, and […]

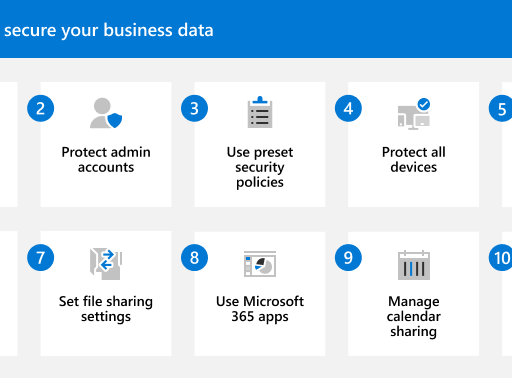

Stop Hackers Gaining Access To Your Small Business Website

To secure your small business website from hackers, frequently update software and enforce strong passwords. Implement robust security protocols to enhance protection against cyber threats. Securing your small business website is critical to protecting your digital presence and customer trust. Hackers constantly evolve their techniques, making it essential for website owners to stay proactive in […]

Top Business Blogger Tips For Beginners

Begin by understanding your audience and consistently creating value-driven content. Engage with your readers through a personable writing style. Starting a business blog can be daunting for newcomers. Crafting compelling content that stands out in a sea of digital information is crucial. To flourish in the competitive blogging landscape, your focus should be on delivering […]

8 Factors Businesses Should Consider When Choosing Financial Advisors

Selecting a financial advisor requires evaluating their credentials and experience. Assessing fees and compatibility with your business goals is crucial. Choosing a financial advisor for your business is a vital decision that can shape your company’s financial health and growth potential. To navigate the complex financial landscape, a reliable advisor must provide tailored advice and […]