Sure, you’ll be able to commerce in a financed automotive.

Credit score: www.oaklawntoyota.com

Buying and selling In A Financed Automotive

Buying and selling in a financed automotive is usually a sensible strategy to improve to a more moderen car or just change to a distinct make or mannequin. Nonetheless, the method of buying and selling in a automotive that you just nonetheless owe cash on is usually a bit extra advanced in comparison with buying and selling in a automotive that you just personal outright. There are a number of elements to contemplate, comparable to figuring out your automotive’s worth, understanding the mortgage payoff quantity, assessing fairness or unfavourable fairness, exploring monetary concerns, and at last, the steps to trade-in a financed automotive.

Figuring out Your Automotive’s Worth

With the intention to commerce in your financed automotive, it is essential to find out its present worth. This will help you negotiate a good deal and keep away from accepting a low trade-in provide. You can begin by researching your automotive’s worth utilizing on-line instruments like Kelley Blue E-book or NADA Guides. These assets present estimated values based mostly on elements such because the automotive’s yr, make, mannequin, situation, mileage, and any extra options.

Understanding Mortgage Payoff Quantity

Figuring out your automotive’s mortgage payoff quantity is crucial when buying and selling in a financed automotive. The mortgage payoff quantity refers back to the remaining steadiness that you just owe in your mortgage. This quantity contains the principal mortgage steadiness plus any amassed curiosity. You will discover this info by contacting your lender or checking your mortgage assertion. Holding observe of your mortgage payoff quantity helps you perceive the full sum of money that you must repay in an effort to absolutely personal the automotive and commerce it in.

Assessing Fairness Or Unfavorable Fairness

Fairness or unfavourable fairness determines whether or not you may have a good or unfavorable monetary state of affairs when buying and selling in a financed automotive. Fairness refers back to the worth your automotive has past the mortgage payoff quantity. In case your automotive’s trade-in worth is larger than the mortgage payoff quantity, you may have optimistic fairness. Alternatively, if the mortgage payoff quantity is larger than the automotive’s trade-in worth, you may have unfavourable fairness, also called being “the other way up” in your mortgage.

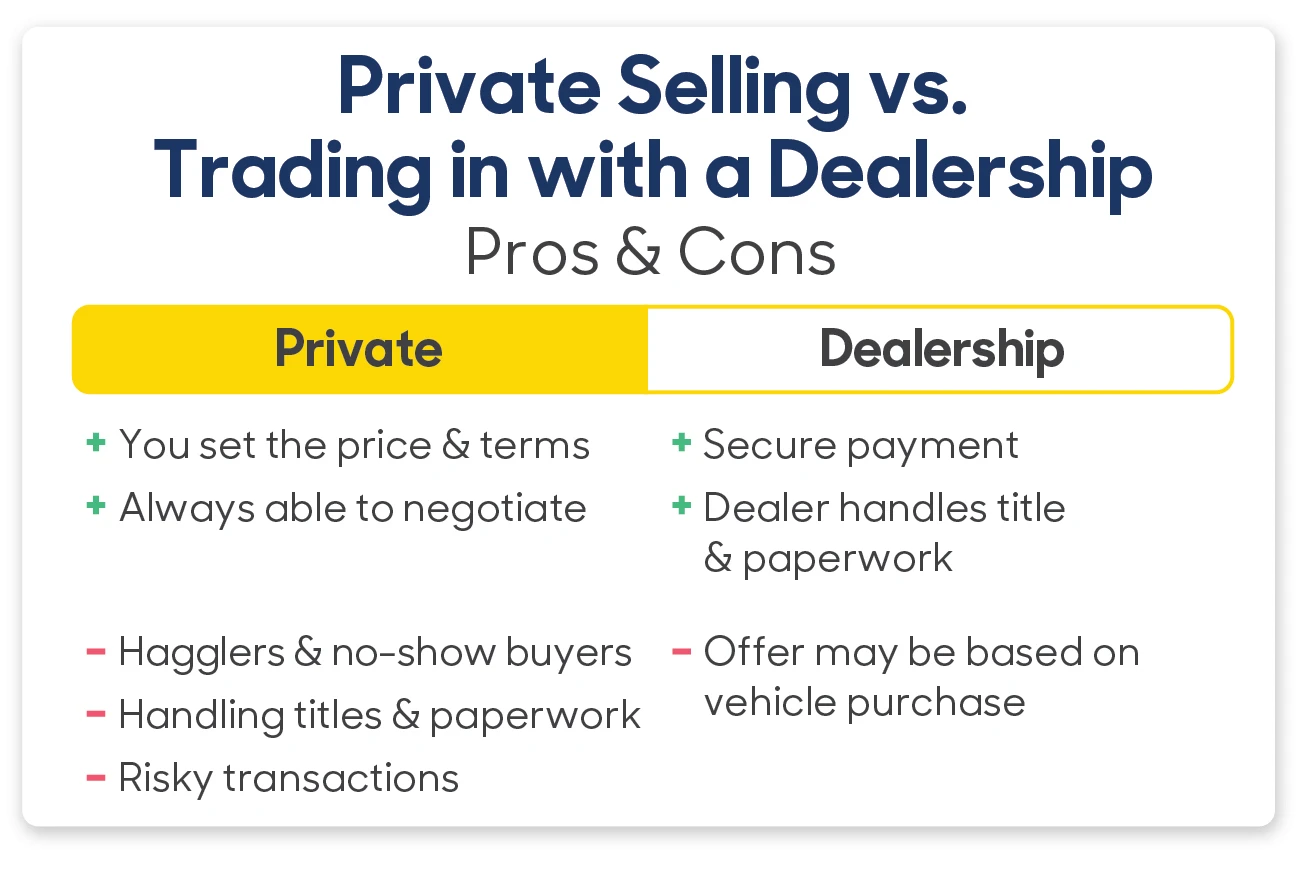

Exploring Monetary Concerns

When buying and selling in a financed automotive, it is vital to contemplate the monetary implications. When you’ve got optimistic fairness, you should use it as a down fee in direction of your subsequent car, lowering your mortgage quantity or permitting you to pay in money for a less expensive car. Nonetheless, unfavourable fairness can complicate issues. When you’ve got unfavourable fairness, you might must pay the distinction in money or roll it into your new mortgage, which can lead to larger month-to-month funds or an extended mortgage time period.

Steps To Commerce-in A Financed Automotive

After getting decided your automotive’s worth, understood the mortgage payoff quantity, and assessed fairness or unfavourable fairness, you might be prepared to maneuver ahead with buying and selling in your financed automotive. Listed here are the steps to comply with:

- Analysis dealerships and their trade-in insurance policies.

- Contact your lender to acquire the mortgage payoff quantity and any essential paperwork.

- Collect all related paperwork, together with the automotive’s title, registration, insurance coverage, and upkeep data.

- Go to totally different dealerships to match trade-in provides.

- Negotiate the trade-in quantity and any extra phrases, comparable to the acquisition value of your new car or the financing choices.

- Assessment and finalize the trade-in settlement, guaranteeing that each one charges and particulars are correctly documented.

- Full the required paperwork for the trade-in and the acquisition of your new car.

- Repay any remaining mortgage steadiness to your lender.

- Switch possession of the traded-in car to the dealership.

- Drive away together with your new automotive!

Credit score: www.wesleychapeltoyota.com

Credit score: www.carmax.com

Conclusion

Buying and selling in a financed automotive could appear advanced, however it’s certainly doable. By understanding the method and dealing carefully together with your lender and the dealership, you can also make a profitable trade-in. Keep in mind to contemplate elements comparable to unfavourable fairness, mortgage payoff, and trade-in worth to make sure a clean transition.

With cautious planning and correct analysis, you’ll be able to navigate the trade-in course of with confidence and comfort.