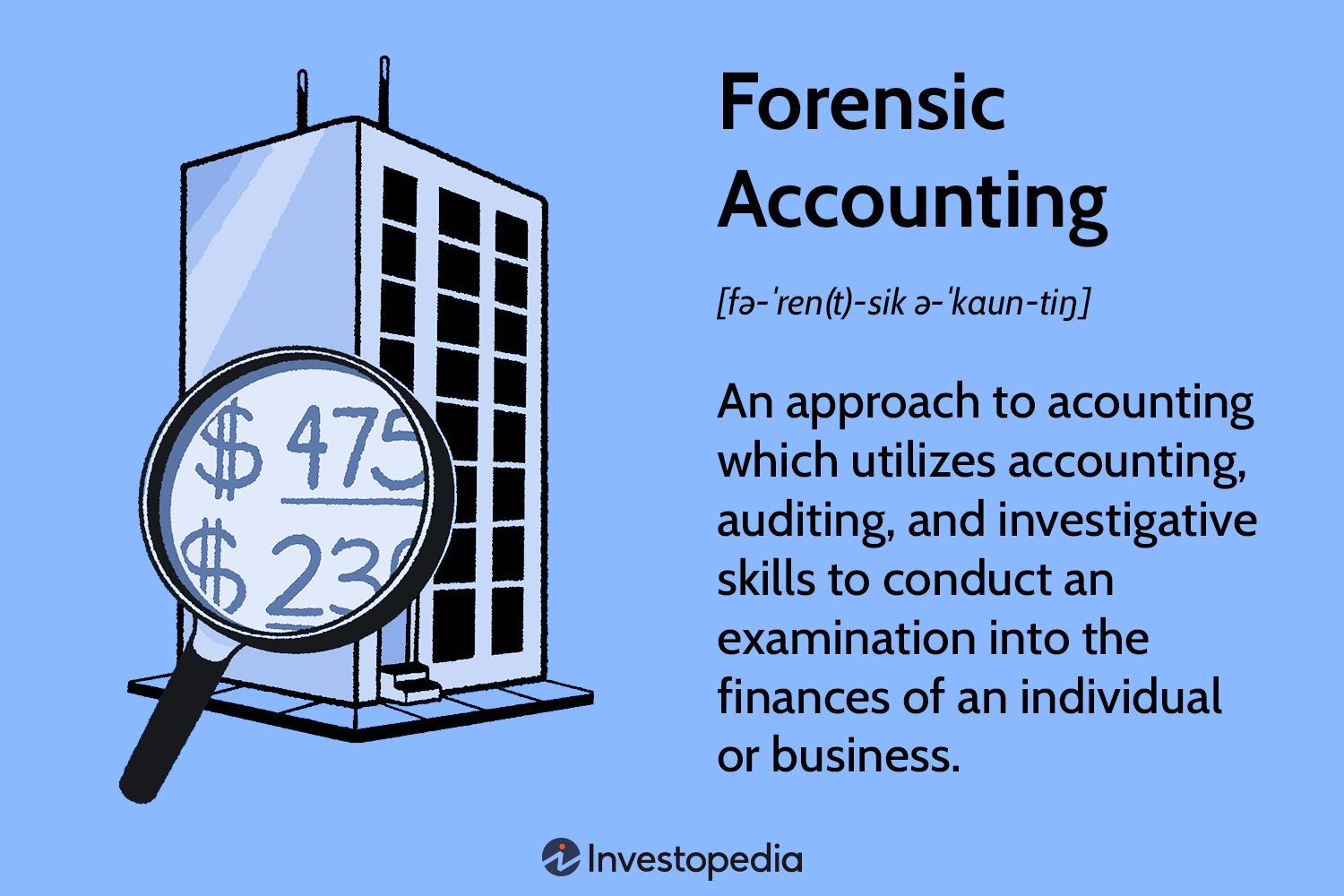

Forensic accounting is a specialized field that uses auditing and investigative skills to examine financial records for legal matters. It plays a crucial role in identifying and preventing business fraud.

Forensic accounting is a critical tool in the modern business landscape, employing meticulous financial analysis to detect and thwart fraud, embezzlement, money laundering, and other financial irregularities. Its practitioners blend accounting, auditing, and investigative skills to not only uncover financial discrepancies but also to assist in legal proceedings.

Businesses often rely on forensic accountants for their expertise in tracing funds, asset identification, and due diligence reviews. These financial sleuths are the sentinels of business integrity, creating a transparent environment that discourages misconduct. By providing clear documentation and professional testimony, they help resolve financial disputes and contribute to the diligent governance of corporate finances, helping to sustain a marketplace where trustworthiness is paramount. Their role extends beyond just number-crunching; they illuminate the financial truth, safeguarding the economic health of businesses and stakeholders alike.

Credit: online.lsu.edu

The Role Of Forensic Accounting In Modern Business

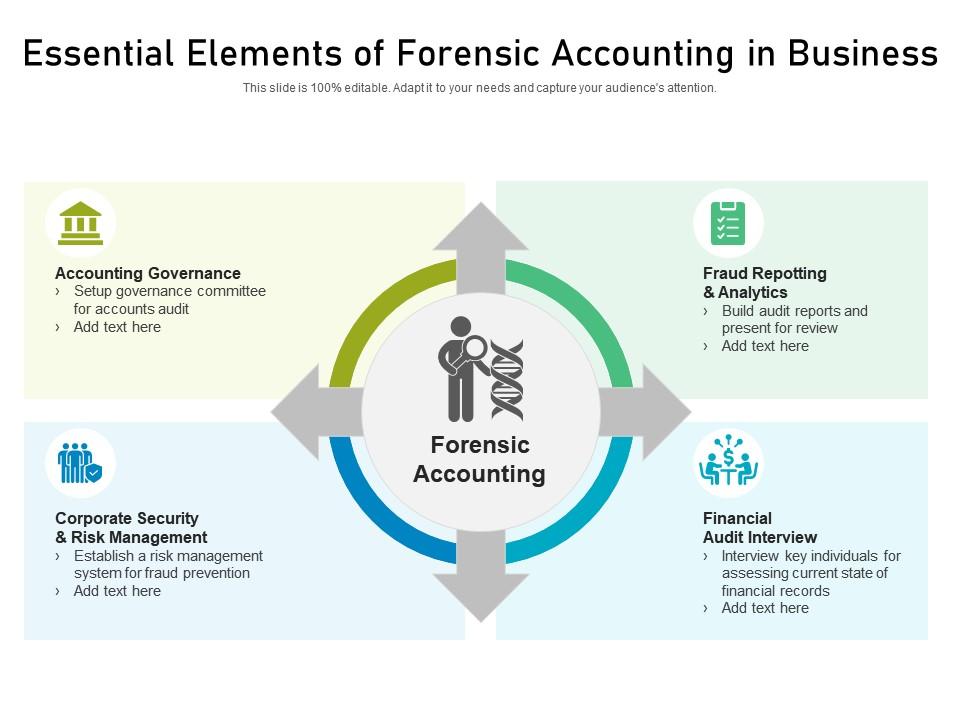

Forensic accounting plays a pivotal role in today’s business landscape. This specialized field involves the integration of accounting, auditing, and investigative skills. Forensic accountants are tasked with uncovering financial fraud, embezzlement, and other irregularities that can have significant implications.

The core functions of forensic accounting include legal support services, fraud detection, and the provision of accounting analysis that is suitable for court. These professionals strive to identify financial misrepresentation, recover stolen assets, and prepare documentation that can serve as evidence in legal proceedings.

Traditional accounting focuses on regular financial reporting and record-keeping. In contrast, forensic accounting delves deep into financial records to find signs of illegal activity. Unlike traditional accountants, forensic specialists possess the skills to dissect financial statements and trace illicit transactions that may be hidden deep within the accounts.

Unveiling Financial Deception

Forensic Accounting plays a pivotal role in identifying and analyzing financial crimes within a business. Experts use a mix of skills to sniff out foul play. They sift through data, seeking signs that don’t fit the pattern. Irregular transactions often leave a trail that these analysts can follow.

Technology is a key ally in this detective work. Software scans through vast amounts of data effortlessly. It flags oddities that might hint at embezzlement or fraud. These tools also compare ledgers and documents, swiftly catching mismatches. It’s a digital deep-dive into a company’s financial practices.

| Technology | Role in Fraud Detection |

|---|---|

| Data Analytics Software | Scours through financial records for anomalies |

| Automated Alert Systems | Notifies analysts of suspicious activities |

| Visual Representation Tools | Creates charts that highlight discrepancies |

Forensic Accounting In Legal Proceedings

Forensic accounting plays a pivotal role in legal proceedings. It assists by providing crucial financial insights. Experts in this field often act as witnesses in courtrooms. Their testimony can make or break a case. Their analysis is key to resolving financial disputes.

These professionals offer detailed reports on financial discrepancies. Their skills are essential for uncovering hidden assets or fraudulent activities. In fact, their input can influence the outcome of litigation.

- Factual evidence is presented clearly.

- Helps judge and jury understand complex financial matters.

- Supports the legal team’s strategy.

Case Studies: Forensic Accounting In Action

Forensic accounting plays a pivotal role in unraveling financial deceit within companies. Its role was evident in the infamous Enron scandal, where forensic accountants exposed a web of fraudulent accounting practices. Their work helped uncover the truth, leading to major reforms in corporate governance. The WorldCom scandal, too, saw forensic accountants playing hero, pinpointing over $3.8 billion in fraudulent expenses.

On the other hand, many small businesses credit their survival to forensic accounting. A bakery, once on the brink of failure, reveled in success after forensic specialists caught an employee siphoning funds. This protective barrier is crucial for maintaining integrity in financial reports. Such actions reinforce the necessity of forensic accounting in safeguarding business interests, big or small.

Becoming A Forensic Accountant

To become a forensic accountant, certain educational paths must be followed. A bachelor’s degree in accounting or a related field is the first step. Many choose to pursue a master’s degree in forensic accounting or a CPA (Certified Public Accountant) certification. Gaining the Certified Fraud Examiner (CFE) designation is also advantageous.

| Skill | Importance |

|---|---|

| Attention to Detail | High |

| Analytical Ability | Critical |

| Communication | Essential |

| Legal Knowledge | Beneficial |

Success in the field requires a keen eye for detail and strong analytical skills. Effective communication helps in presenting findings. Understanding legal principles can distinguish forensic accountants in their work.

Credit: hwllp.cpa

Credit: www.slideteam.net

Conclusion

Forensic accounting stands as a critical defense against financial malfeasance. Armed with detailed knowledge, businesses can shield their interests and uphold integrity. It’s a specialized skill set; every enterprise may well consider its value. Embrace forensic insights and pave the way for a transparent, secure financial future.

:max_bytes(150000):strip_icc()/renting-vs-owning-home-pros-and-cons.asp-ADD-V2-2ce9de919eb94f62bd4e4c7a23010852.jpg)