To get debtors to pay your small business, establish clear payment terms and communicate effectively. Utilize reminders, offer payment plans, and consider collection agencies as a last resort.

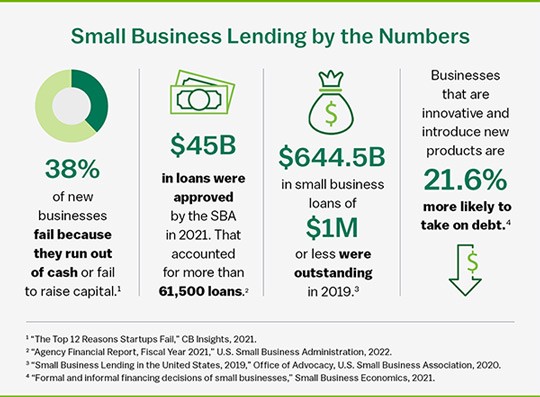

Small businesses thrive on a stable cash flow, and when debtors delay payments, it can significantly disrupt operations. Ensuring that your clients or customers adhere to their payment obligations requires a strategic and sensitive approach. A key initial step is to clearly outline payment terms before entering into agreements, thereby setting expectations from the start.

Maintaining professional, yet firm communication is crucial; reminding debtors of their dues in a timely manner can help in securing payments. For those particularly challenging cases, offering flexible payment options can facilitate the collection process, and as a final measure, small businesses might turn to reputable collection agencies or legal action to recover unpaid debts. By following these steps and emphasizing respectful persistence, small businesses can effectively manage their receivables and maintain healthy financial practices.

The Psychology Behind Late Payments

Understanding why customers delay payments is crucial for small businesses. Offering early payment discounts can motivate clients to settle invoices quickly. Ensure your payment terms are clear to avoid misunderstandings. Streamlining the billing process also helps in getting paid sooner. It’s beneficial to have multiple payment options available, catering to the convenience of your clients.

Many factors contribute to late payments. Sometimes clients face their own cash flow issues. Other times, invoices may get overlooked or lost in a busy workflow. It’s essential to send gentle reminders for payment, perhaps trough a system that automates this process. Keep communication lines open and aim to build strong relationships with customers. This approach can often turn a late payer into a prompt one.

Credit: www3.mtb.com

Setting Up Clear Payment Terms

Setting clear payment terms is crucial for small business financial health. A transparent invoicing system should outline specific due dates and acceptable payment methods. To ensure clients understand their obligations, consider these steps:

- Clearly label invoice due dates.

- Use simple language to detail payment terms.

- State late payment penalties upfront.

Payment deadlines are powerful tools for prompt payment. They signal to debtors the importance of timeliness. Swift payment supports your business’s cash flow and sustains day-to-day operations.

Communication Strategies With Debtors

Initiating a payment discussion is all about being clear and professional. Your first talk should set a positive tone. Explain the situation simply, using easy words. Make sure they understand why you’re reaching out.

For following up without being confrontational, keep it friendly and direct. Sending a reminder can refresh their memory. Don’t sound angry or upset; this might make them less willing to pay.

:max_bytes(150000):strip_icc()/costofdebt2-396ca7f9589d49c8a2ed985d631635e9.jpg)

Credit: www.investopedia.com

Leveraging Payment Reminders And Notices

Crafting effective reminders is key to getting paid on time. Use clear, polite language to remind debtors of their pending dues. Ensure all details, like the due date and amount, are highlighted. Send these reminders at regular intervals.

Moving on to escalating notices, approach with caution. Each notice should gradually become more firm. Start with gentle reminders. If ignored, send more direct notices. The tone should convey urgency, but maintain professionalism. Escalate methodically, giving debtors a chance to respond.

| Reminder Type | Action |

|---|---|

| Initial Reminder | Send polite email detailing invoice |

| Follow-up | Another email, include a payment link |

| Final Notice | More formal, warn of next steps |

Legal Recourse For Non-paying Clients

Legal recourse is crucial for small businesses faced with non-paying clients. Small Claims Court offers a path to resolve disputes without a hefty legal bill. Litigate claims within state’s monetary limits here.

Often, businesses resort to Small Claims Court when owed amounts fall under a certain threshold. These courts streamline the legal process, aiming at swift justice. Businesses must file a claim, serve papers to debtors, and present their case in court. It’s a less formal environment, yet judgments are legally binding.

Should the debtor still resist payment after a court judgment, consider hiring a collection agency. These agencies specialize in debt recovery, with tools and strategies to legally pressure debtors. They work on a contingency basis, usually taking a percentage of the collected debt.

:max_bytes(150000):strip_icc()/digging-out-of-debt_final-b14f7e15866443b3a3b87745ea178ef8.png)

Credit: www.investopedia.com

Preventive Measures To Minimize Future Delays

Screening clients for creditworthiness is a key step. It helps to ensure that clients can and will pay. Look at their credit history. Check their financial stability. This can be done by reviewing credit reports. Or you could ask for references from other businesses. A solid track record means they’re likely good to work with.

Requesting advance payments or deposits is also smart. It secures a portion of your payment upfront. This method lessens the risk of non-payment. It also shows the client’s commitment to the deal. Usually, a small percentage of the total cost is asked for. This can be 20-50% in advance, depending on your business model.

Conclusion

Securing owed payments is crucial for your small business’s cash flow. Adopt clear communication, set firm policies, and leverage legal remedies when needed. Remember, persistence pays off. Strengthen your strategies, and watch your business thrive on timely recoveries. Let’s turn those outstanding debts into successes.