To operate as a sole trader, register your business with the appropriate authorities and keep accurate financial records. Understand the legal requirements, such as taxes and insurances, that come with sole proprietorship.

Running a business as a sole trader is both an exciting and challenging endeavor. It’s crucial to start with a solid foundation by ensuring compliance with local business regulations and tax laws. Establishing your business takes more than just a great idea; it involves meticulous planning and organization.

You’ll need to manage all aspects, from financial documentation to marketing strategies. Additionally, maintaining clear and organized records not only simplifies annual tax filings but also provides valuable insights into your business operations. The key lies in balancing the creative side of running your enterprise with the diligence of administrative tasks. Keep up with industry changes and continually refine your business approach to stay successful and grow as a sole trader.

:max_bytes(150000):strip_icc()/dotdash_Final_Sole_Proprietorship_May_2020-01-72456bd5ac0d4c868d8f55a2718dbdd2.jpg)

Credit: www.investopedia.com

Who Is A Sole Trader?

A sole trader is someone who owns and runs their own business. It is a simple way to start a business. You make all the decisions and keep all profits. But, you must also handle all your business debts.

Sole traders do not have a separate legal entity from their owner. This means that personal assets can be at risk. Debts and losses might affect your personal finances. It’s important to understand the legal status and personal liability.

| Pros | Cons |

|---|---|

| Easy to set up | Unlimited liability |

| Full control | Risk to personal assets |

| Keep all profits | Responsible for debts |

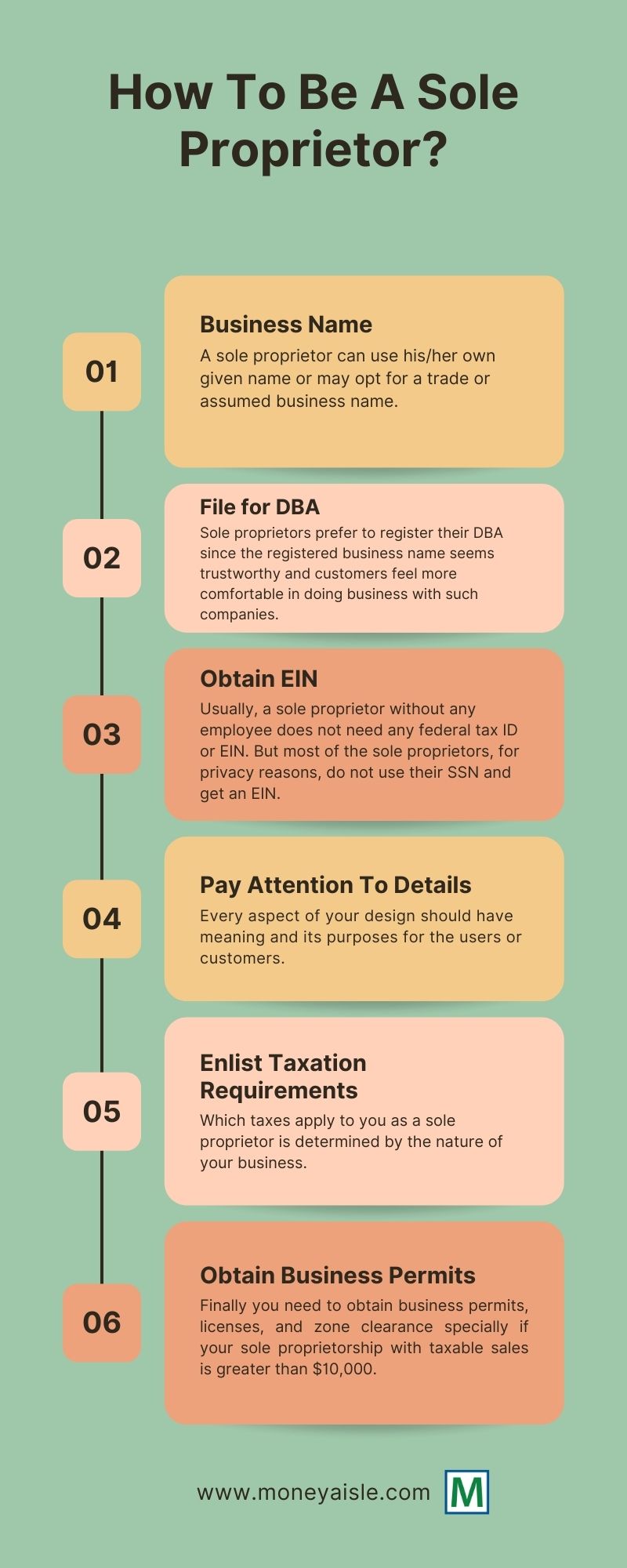

Setting Up Your Sole Trader Business

Operating a business as a sole trader starts with registration essentials. First, obtain a Tax File Number (TFN) and register for GST if needed. Registrations vary by state, so check local requirements.

Choosing the perfect business name is vital. It identifies your brand and sets you apart. Make sure it’s unique, memorable, and resonates with your target audience.

To manage your finances, understand tax obligations thoroughly. It includes income tax, GST, and other potential levies. Staying informed on tax matters is crucial for financial health. Always keep accurate records for smooth operations.

Managing Finances As A Sole Trader

Operating your business as a sole trader demands organized finances. Begin by opening a business bank account to track company transactions accurately. It’s essential for clarifying tax commitments and offers a professional edge with clients.

Keep detailed records of all your business activities. Implement a robust system for managing invoices, receipts, and expense tracking. This diligence simplifies your annual tax filing and keeps finances in check.

Separating personal and business finances is crucial. Use distinct accounts for each to avoid confusion and maintain clear financial boundaries. This separation aids in crafting a strong financial foundation for your sole proprietorship.

Credit: www.moneyaisle.com

Growth Strategies For Sole Traders

Growth strategies are crucial for sole traders seeking success. Investing in marketing can significantly boost your business’s visibility. This may involve enhancing your online presence, leveraging social media, or creating engaging content.

Expanding your service or product line also presents opportunities for growth. Consider your customers’ needs and introduce new offerings accordingly. Constant innovation is vital in keeping the business dynamic and competitive.

To widen your market reach, consider networking and collaborations. Partnerships with other businesses can open new avenues. Attend industry events to connect with peers and potential clients. Such relationships can lead to beneficial synergies.

Overcoming Common Challenges

Operating a business as a sole trader often means facing a rollercoaster of financial ebbs and flows. Creating a budget and building an emergency fund can buffer against months with lower income. Diversifying services and products also helps stabilize earnings.

Effective time management is crucial for sole traders. Utilizing tools such as digital planners and productivity apps maximizes efficiency. Setting clear goals and breaking tasks into smaller steps fosters better time utilization.

Access to funding and resources can be challenging. Exploring small business grants, microloans, and crowdfunding platforms presents potential solutions. Networking with other entrepreneurs offers valuable insights and support.

Planning For The Future

Operating a business as a sole trader requires careful future planning. Setting long-term goals is crucial for sustained success. Goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

For retirement planning, start by determining your desired retirement age and lifestyle. Then, calculate the necessary savings, considering tax implications and investment strategies that suit your business earnings. Engaging with a financial planner can help tailor a retirement plan that aligns with personal and business goals.

As your business grows, transition to a company structure can be beneficial. It might offer limited liability, tax advantages, and easier access to capital. Seek legal and financial advice to understand the implications and processes involved in this transition.

Credit: www.sbdc.duq.edu

Conclusion

Navigating the sole trader landscape requires strategy and dedication. Embrace the flexibility, and tackle challenges with confidence. Leverage the tips shared here to streamline operations and boost growth. Remember, the journey is unique; your tenacity and innovation are key to success.

Seek advice, keep learning, and watch your business thrive.