PayPal’s acceptance of cryptocurrency could lower transaction fees and increase payment options for businesses. It signals mainstream crypto adoption, potentially impacting sales and market reach.

The integration of cryptocurrency payments through PayPal offers businesses an edge in the evolving digital economy. As one of the most reputable online payment systems, PayPal’s move to embrace crypto transactions heralds a significant shift in financial operations and consumer payment preferences.

It allows companies to tap into a growing base of tech-savvy customers who prioritize security, privacy, and the efficiency of blockchain technology. This development not only elevates the credibility of cryptocurrencies but also equips forward-thinking businesses with innovative tools to expand their customer base and streamline payment processes. Smaller businesses might benefit from the increased accessibility and reduced barriers to entry in international markets, potentially accelerating their growth and enhancing competitiveness.

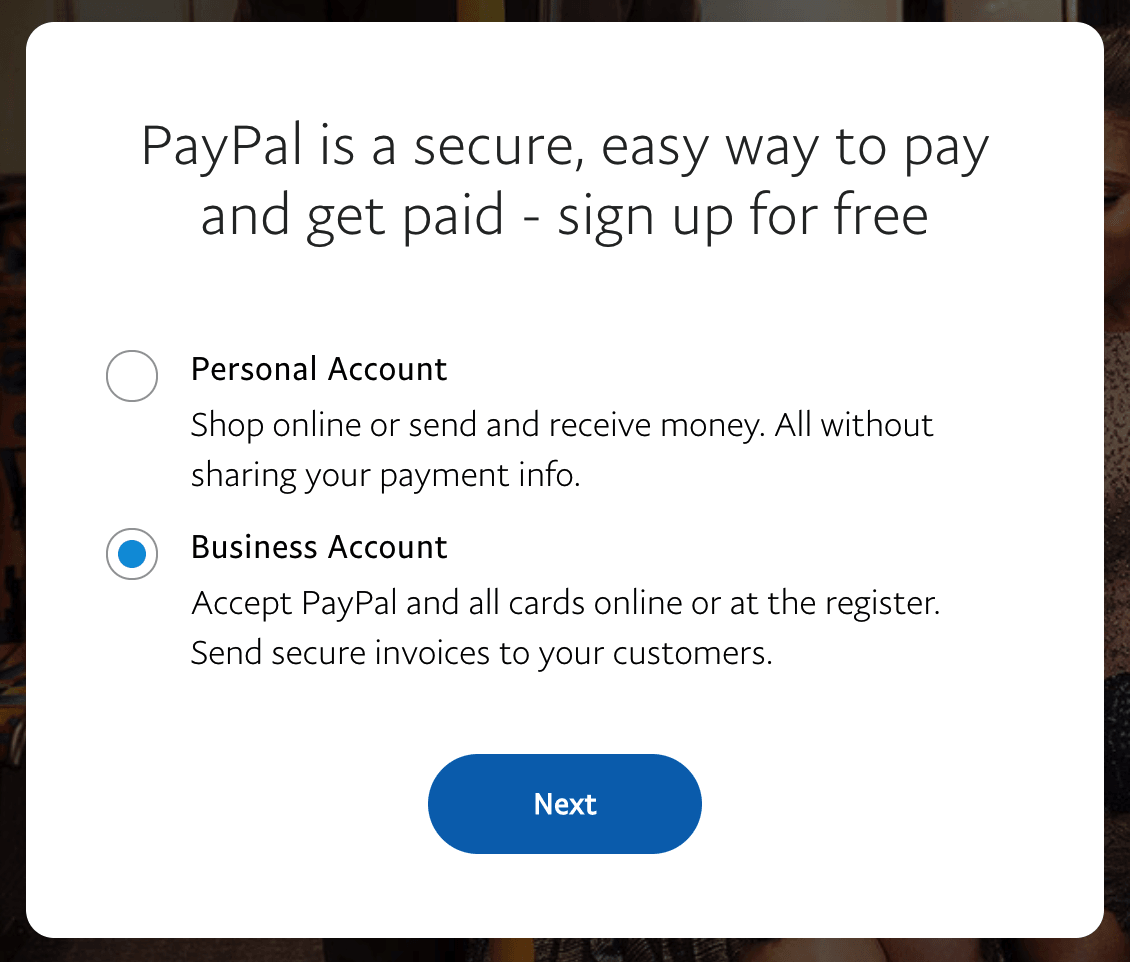

Paypal Enters The Crypto Arena

PayPal’s move into cryptocurrency opens new doors for businesses. Their announcement signals a major shift in digital payment options. Businesses can now expect a broader customer base, ready to use digital currencies for transactions. PayPal’s platform may drive increased adoption of crypto, making it more mainstream. This change promises to simplify payments across borders and reduce transaction costs, giving enterprises a competitive edge. With PayPal embracing crypto, retailers and service providers must stay informed about the latest developments in digital finance.

PayPal supports several prominent cryptocurrencies, such as Bitcoin, Ethereum, Bitcoin Cash, and Litecoin. These digital assets mark the beginning of a new era for business transactions. Small and large businesses alike will need to understand the implications of accepting these cryptocurrencies. It is crucial to adapt to this change to keep business operations smooth and customer-friendly.

Credit: www.paypal.com

Impact On Business Transactions

Paypal’s leap into cryptocurrency heralds significant changes for business dealings. Companies now enjoy greater transactional elasticity, courtesy of this integration. Businesses can receive payments in various digital currencies, a nod to flexibility.

Global sales vistas swing wide open with Paypal embracing crypto. Merchants can conveniently cater to a broader, crypto-savvy customer base. This shift promises an uptick in international commerce and customer reach. Borderless transactions shall become the norm, propelling businesses onto a global stage.

Security Implications For Businesses

The adoption of cryptocurrency by PayPal presents a crucial enhancement in fraud protection. Utilizing advanced blockchain technology, businesses can expect a reduction in unauthorized transactions. PayPal’s security protocols, coupled with cryptocurrency’s inherent features, create a powerful barrier against fraud.

PayPal’s custodial services offer an extra layer of security for business transactions. They keep crypto assets in a secured environment. This minimizes risks associated with crypto storage and management. Hence, businesses benefit from PayPal’s trusted reputation and its sophisticated security infrastructure.

Influence On Cryptocurrency Adoption

The entry of PayPal into crypto signals a big change. Business adopt crypto faster as trust grows. PayPal’s reputation adds credibility to crypto. This move can lead to more people using digital currencies. A potential increase in crypto users is on the horizon. Digital transactions with crypto may become more common.

Impacts On Transaction Fees And Speed

PayPal’s acceptance of cryptocurrency could bring significant benefits to businesses. One major perk could be a decrease in transaction fees. Typically, credit card companies charge percentages per transaction. Crypto transactions could lower these costs, saving businesses money.

The speed of settlement is another area with potential improvement. Crypto transactions can settle almost instantly. This means businesses can access their funds faster than traditional bank processing times. Quick access to cash is crucial for business operations and growth.

:max_bytes(150000):strip_icc()/paypal.asp-final-1101556384f049bf9f24d7ad7a59494c.jpg)

Credit: www.investopedia.com

Regulatory And Compliance Considerations

Businesses must understand new rules when accepting crypto through PayPal. Anti-Money Laundering (AML) laws are crucial. They stop illegal cash flow. Companies also need Know Your Customer (KYC) standards. These standards help know who the customers are.

Their goals are to keep business transparent and crime-free. As PayPal steps into crypto, businesses could shape future laws. Their experiences might influence new rules.

Future Outlook For E-commerce

With PayPal embracing cryptocurrencies, e-commerce platforms anticipate vast changes. Digital payments are evolving quickly. Business owners should prepare for customers using Bitcoin or Ethereum. This shift creates opportunities for new markets and consumer segments. Companies keeping pace with payment technology may gain a competitive edge. Digital currencies might become as common as credit cards. Customer experience could improve with more payment choices.

Experts foresee cryptocurrencies helping global sales. Secure and fast transactions could boost customer trust and satisfaction. It’s likely that crypto will integrate into existing financial systems. Doing so enhances their utility in daily commerce. Businesses that adapt to these changes may see increased growth and loyalty.

Credit: woo.com

Conclusion

PayPal’s embrace of cryptocurrency marks a significant shift for modern commerce. Businesses stand to gain from widened payment options and potential customer base expansion. Blockchain’s transparency and efficiency could streamline transactions. Adapting to this change is now vital for competitive edge.

Embrace the crypto evolution, and your business may thrive.